Exchange Traded Funds (ETFs) are investment vehicles traded on stock exchanges, similar to individual stocks. They are designed to track the performance of specific indices, commodities, bonds, or asset combinations. ETFs offer investors portfolio diversification and exposure to various assets through a single investment.

These funds are characterized by low expense ratios and tax efficiency, appealing to both individual and institutional investors. ETFs can be traded throughout the day at market prices, providing liquidity and flexibility. They offer transparency through daily disclosure of holdings, allowing investors to view their exact asset allocations.

ETFs are versatile and can be utilized for various investment strategies, including long-term investing, short-term trading, and market volatility hedging. The popularity of ETFs has increased in recent years due to their adaptability, transparency, and cost-effectiveness. They enable investors to gain exposure to diversified asset portfolios efficiently and economically.

ETFs are suitable for a wide range of investment objectives and can be easily incorporated into various financial strategies.

Key Takeaways

- ETFs are investment funds traded on stock exchanges, providing diversification and liquidity to investors.

- Diversifying your portfolio with ETFs can help spread risk and potentially increase returns.

- Sector-specific ETFs allow investors to focus on specific industries or sectors for potential higher returns.

- ETFs can be leveraged in a bull market to maximize returns and take advantage of upward trends.

- Inverse ETFs can be used to hedge against market volatility and potentially profit from market downturns.

- ETFs offer tax efficiency and cost savings compared to traditional mutual funds.

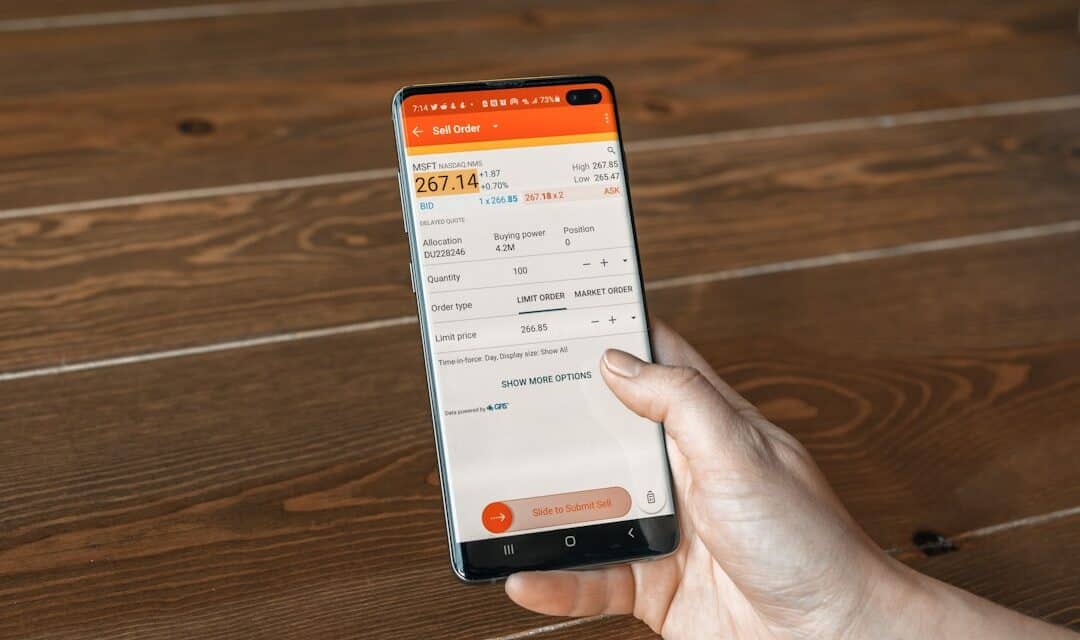

- Strategies for maximizing returns with ETFs include dollar-cost averaging, rebalancing, and using limit orders for buying and selling.

Diversifying Your Portfolio with ETFs

Diversification is a key principle of investing, and ETFs offer an easy and cost-effective way to achieve it. By investing in ETFs that track different asset classes, sectors, or regions, investors can spread their risk and reduce the impact of any single investment on their overall portfolio. For example, an investor can diversify their portfolio by investing in ETFs that track stocks, bonds, commodities, and real estate.

This can help mitigate the impact of market volatility and economic downturns on their investments. Furthermore, ETFs provide access to international markets, allowing investors to diversify their portfolios beyond domestic assets. By investing in ETFs that track international stocks or bonds, investors can gain exposure to different economies and currencies, reducing their reliance on the performance of their home country’s markets.

Overall, diversifying a portfolio with ETFs can help investors achieve a more balanced and resilient investment strategy. Diversification is a key principle of investing, and ETFs offer an easy and cost-effective way to achieve it. By investing in ETFs that track different asset classes, sectors, or regions, investors can spread their risk and reduce the impact of any single investment on their overall portfolio.

For example, an investor can diversify their portfolio by investing in ETFs that track stocks, bonds, commodities, and real estate. This can help mitigate the impact of market volatility and economic downturns on their investments. Furthermore, ETFs provide access to international markets, allowing investors to diversify their portfolios beyond domestic assets.

By investing in ETFs that track international stocks or bonds, investors can gain exposure to different economies and currencies, reducing their reliance on the performance of their home country’s markets. Overall, diversifying a portfolio with ETFs can help investors achieve a more balanced and resilient investment strategy.

Maximizing Returns with Sector-Specific ETFs

Sector-specific ETFs allow investors to focus on specific industries or sectors of the economy. By investing in ETFs that track sectors such as technology, healthcare, energy, or consumer goods, investors can capitalize on the growth potential of these industries. Sector-specific ETFs provide exposure to companies within a particular sector, allowing investors to benefit from the performance of those companies without having to pick individual stocks.

Furthermore, sector-specific ETFs can be used to implement tactical investment strategies based on market trends and economic conditions. For example, if an investor believes that the technology sector is poised for growth, they can invest in a technology sector ETF to capitalize on this potential opportunity. Additionally, sector-specific ETFs can be used to overweight or underweight certain sectors within a portfolio based on market outlook and investment goals.

Overall, sector-specific ETFs provide investors with a targeted approach to maximizing returns within specific areas of the economy. Sector-specific ETFs allow investors to focus on specific industries or sectors of the economy. By investing in ETFs that track sectors such as technology, healthcare, energy, or consumer goods, investors can capitalize on the growth potential of these industries.

Sector-specific ETFs provide exposure to companies within a particular sector, allowing investors to benefit from the performance of those companies without having to pick individual stocks. Furthermore, sector-specific ETFs can be used to implement tactical investment strategies based on market trends and economic conditions. For example, if an investor believes that the technology sector is poised for growth, they can invest in a technology sector ETF to capitalize on this potential opportunity.

Additionally, sector-specific ETFs can be used to overweight or underweight certain sectors within a portfolio based on market outlook and investment goals. Overall, sector-specific ETFs provide investors with a targeted approach to maximizing returns within specific areas of the economy.

Leveraging the Power of ETFs in a Bull Market

| ETF Name | Performance | Expense Ratio | Assets Under Management |

|---|---|---|---|

| S&P 500 ETF | 10% | 0.03% | 300 billion |

| Technology Sector ETF | 15% | 0.10% | 50 billion |

| Financial Sector ETF | 12% | 0.08% | 80 billion |

In a bull market environment where stock prices are rising and investor sentiment is positive, ETFs can be used to capitalize on the upward momentum of the market. Investors can invest in broad-based equity ETFs that track major stock indices such as the S&P 500 or the Nasdaq Composite to gain exposure to the overall market performance. Additionally, sector-specific ETFs can be used to target industries that are expected to outperform during a bull market, such as technology or consumer discretionary.

Furthermore, leveraged ETFs provide investors with the opportunity to amplify their returns in a bull market environment. These ETFs use financial derivatives and debt to magnify the returns of an underlying index or asset class. While leveraged ETFs offer the potential for higher returns, they also come with higher risk due to their use of leverage.

Therefore, investors should carefully consider their risk tolerance and investment objectives before investing in leveraged ETFs in a bull market. In a bull market environment where stock prices are rising and investor sentiment is positive, ETFs can be used to capitalize on the upward momentum of the market. Investors can invest in broad-based equity ETFs that track major stock indices such as the S&P 500 or the Nasdaq Composite to gain exposure to the overall market performance.

Additionally, sector-specific ETFs can be used to target industries that are expected to outperform during a bull market, such as technology or consumer discretionary. Furthermore, leveraged ETFs provide investors with the opportunity to amplify their returns in a bull market environment. These ETFs use financial derivatives and debt to magnify the returns of an underlying index or asset class.

While leveraged ETFs offer the potential for higher returns, they also come with higher risk due to their use of leverage. Therefore, investors should carefully consider their risk tolerance and investment objectives before investing in leveraged ETFs in a bull market.

Hedging Against Market Volatility with Inverse ETFs

Inverse ETFs are designed to profit from declining prices in a particular index or asset class. These ETFs use derivatives such as futures contracts and options to generate returns that are inversely correlated to the performance of their underlying index or asset class. Inverse ETFs can be used as a hedging tool to protect against market downturns and mitigate potential losses in a volatile market environment.

Investors can use inverse ETFs to hedge against specific risks within their portfolios or to profit from short-term market movements. For example, if an investor believes that the stock market is poised for a decline, they can invest in an inverse equity ETF to profit from falling stock prices. However, it’s important to note that inverse ETFs are designed for short-term trading purposes and may not be suitable for long-term investments due to compounding effects and tracking errors.

Inverse ETFs are designed to profit from declining prices in a particular index or asset class. These ETFs use derivatives such as futures contracts and options to generate returns that are inversely correlated to the performance of their underlying index or asset class. Inverse ETFs can be used as a hedging tool to protect against market downturns and mitigate potential losses in a volatile market environment.

Investors can use inverse ETFs to hedge against specific risks within their portfolios or to profit from short-term market movements. For example, if an investor believes that the stock market is poised for a decline, they can invest in an inverse equity ETF to profit from falling stock prices. However, it’s important to note that inverse ETFs are designed for short-term trading purposes and may not be suitable for long-term investments due to compounding effects and tracking errors.

Tax Efficiency and Cost Savings with ETFs

ETFs are known for their tax efficiency due to their unique structure and creation/redemption process. Unlike mutual funds, which incur capital gains taxes when fund managers buy and sell securities within the fund, ETF shareholders are not subject to capital gains taxes unless they sell their shares at a profit. This tax advantage makes ETFs an attractive option for taxable investment accounts.

Additionally, ETFs typically have lower expense ratios compared to mutual funds, making them a cost-effective investment option for investors. The passive management style of most ETFs results in lower management fees and operating expenses compared to actively managed mutual funds. Furthermore, since most ETFs track an index rather than actively selecting securities, they have lower portfolio turnover which reduces trading costs and capital gains distributions.

ETFs are known for their tax efficiency due to their unique structure and creation/redemption process. Unlike mutual funds, which incur capital gains taxes when fund managers buy and sell securities within the fund, ETF shareholders are not subject to capital gains taxes unless they sell their shares at a profit. This tax advantage makes ETFs an attractive option for taxable investment accounts.

Additionally, ETFs typically have lower expense ratios compared to mutual funds, making them a cost-effective investment option for investors. The passive management style of most ETFs results in lower management fees and operating expenses compared to actively managed mutual funds. Furthermore, since most ETFs track an index rather than actively selecting securities, they have lower portfolio turnover which reduces trading costs and capital gains distributions.

Strategies for Maximizing Returns with ETFs

There are several strategies that investors can use to maximize returns with ETFs. One strategy is dollar-cost averaging, where investors regularly invest a fixed amount of money into an ETF regardless of its price. This strategy allows investors to buy more shares when prices are low and fewer shares when prices are high, ultimately lowering the average cost per share over time.

Another strategy is rebalancing a portfolio by periodically adjusting the allocation of assets within an ETF portfolio based on investment goals and risk tolerance. Rebalancing ensures that the portfolio remains aligned with the investor’s long-term objectives and helps capture gains from outperforming assets while buying undervalued assets. Furthermore, investors can use asset allocation strategies by combining different types of asset classes within their portfolios using various ETFs.

By diversifying across asset classes such as stocks, bonds, commodities, and real estate through different ETF investments, investors can achieve a balanced portfolio that aligns with their risk tolerance and investment objectives. There are several strategies that investors can use to maximize returns with ETFs. One strategy is dollar-cost averaging, where investors regularly invest a fixed amount of money into an ETF regardless of its price.

This strategy allows investors to buy more shares when prices are low and fewer shares when prices are high, ultimately lowering the average cost per share over time. Another strategy is rebalancing a portfolio by periodically adjusting the allocation of assets within an ETF portfolio based on investment goals and risk tolerance. Rebalancing ensures that the portfolio remains aligned with the investor’s long-term objectives and helps capture gains from outperforming assets while buying undervalued assets.

Furthermore, investors can use asset allocation strategies by combining different types of asset classes within their portfolios using various ETFs. By diversifying across asset classes such as stocks, bonds, commodities, and real estate through different ETF investments, investors can achieve a balanced portfolio that aligns with their risk tolerance and investment objectives. In conclusion, Exchange Traded Funds (ETFs) offer investors numerous benefits including diversification opportunities across various asset classes and sectors while providing cost-effective access to international markets through transparent investment vehicles that trade like individual stocks on major exchanges around the world.

By understanding how these financial instruments work and how they can be utilized effectively within different market environments such as bull markets or periods of increased volatility through strategies like dollar-cost averaging or rebalancing portfolios based on changing market conditions will help maximize returns while minimizing risks associated with investing in these products.

Overall it’s clear that Exchange Traded Funds (ETF) have become an essential part of any well-diversified investment portfolio due largely because they offer tax efficiency along with cost savings compared traditional mutual funds making them attractive options for both individual retail investors as well as institutional clients looking for ways diversify their holdings while minimizing costs associated with managing these investments over time.

If you’re interested in learning more about exchange traded funds, you might want to check out this article on personal capital budgeting. This article discusses the importance of budgeting and managing your personal finances, which is essential for anyone looking to invest in ETFs. Understanding your own financial situation and goals is crucial when considering any investment, including ETFs.